GM DDians! The season is bullish, and we have brought you this week’s juiciest stories, so that you can spruce up your profits, just in time 🤑 Here’s what we have for you in today’s issue:

- Bitcoin Big Boys Club Going Strong 💪

- Ethereum’s Euphoria Mode On 🤩

- The $260M SUI DEX letdown 😢

The Bitcoin Big Boy Bonhomie is Now Official🚀

Bitcoin price hit a new all-time high of $111,888 this week.

A 6-figure Bitcoin price is quickly becoming the norm in the crypto market. It’s time you start getting used to it.

Bitcoin has clocked multiple all-time highs in the past, but this time it’s different. This all-time high isn’t a “magic money bubble” but an undeniable sign of growing institutional confidence.

Let’s see why:

- US Treasuries aren’t attractive anymore. After a lacklustre $16 billion 20-Year bond auction, yields rocketed to 5.127%, signalling a lack of interest and weak demand.

United States 20-Year Government Bonds Yield 1-Week Chart, Source: TradingView

In simpler words, bond yields go up when bond prices (read US Treasury bill prices) go down and vice versa. Hence, rising yields signal their holders (mostly institutions) to look for greener pastures elsewhere. This situation also points to higher borrowing costs, mortgage rates, and the stale state of the economy in general.

All this cumulative chaos triggered a massive sell-off of U.S. government assets, including the dollar. Since Trump assumed the presidency in January of this year, the greenback has sunk to multi-week lows.

Trump’s sweeping tax-cut bill was passed “narrowly” in the US House of Representatives. It is estimated to add nearly $4 trillion (over the next decade) to the US debt ceiling, which is currently pegged at $36.2 trillion. The US economy is bound to falter much more, and that has pushed Moody’s to downgrade the US’s credit rating from AAA to AA1.

U.S. Dollar Index 1 Week Chart, Source: TradingView

With the US Dollar wobbling and the fiat system creaking, smart money is switching investment preferences. Gold is already the de facto safe-haven asset. Bitcoin is beginning to act like one as well:

- Bitcoin ETFs posted record inflows, clocking a single-day inflow of $609 million during the green week.

- Wall Street’s capital is rotating from TradFi to Bitcoin and crypto markets. Dollar’s loss is Bitcoin’s gain. As simple as that.

Source: @kyledoops

Source: @QuintenFrancois

$111,888 isn’t just a number. It’s the beginning of a “brave new world” of capital allocation, with Bitcoin leading the game.

With BTC’s price discovery mode on at least until $140K, we might just be getting started.

We hope you have enough skin in the game😉

Ethereum Grabs Bears By Their Balls 😎

Ethereum’s Pectra upgrade went live on May 7.

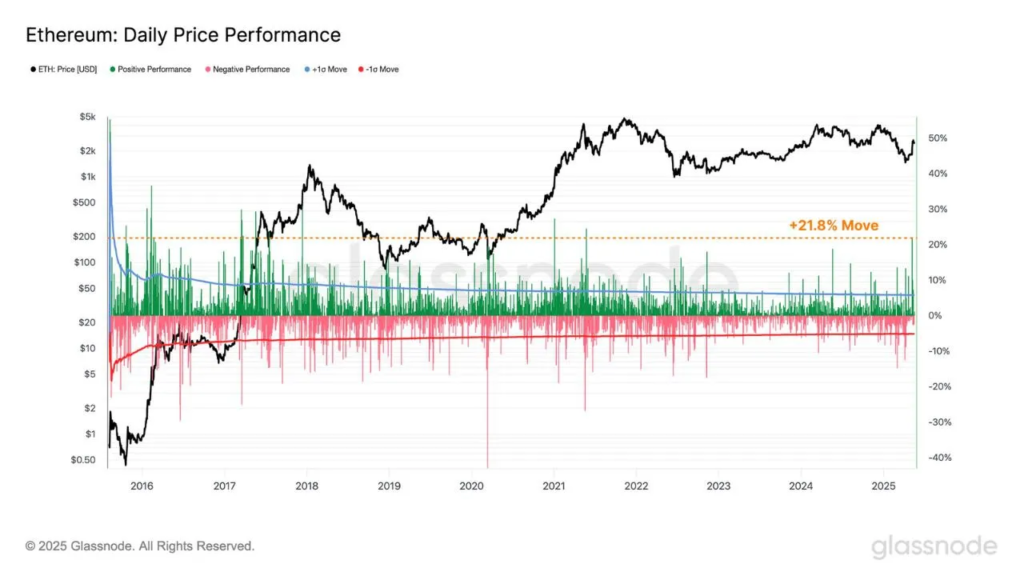

And ETH printed a single-day 21.8% upward movement, forcing bears and short sellers to throw in the towel.

Ethereum ETHUSD Daily Price Performance, Source: Glassnode

In the shocking flight to $2,700, the number 2 cryptocurrency flipped key price levels that signal a change of things for Ether.

Ethereum ETHUSD Key Pricing Levels, Source: Glassnode

From the data above, it is quite clear that:

- The ETHUSD pair’s surpassing the “Realized Price” level of $1,900 has made average long-term ETH holders profitable. This was the first step for Ether to get its bull mode on, but it didn’t stop there.

- The coin’s “True Market Mean” price level of $2,400 was also shattered on its way up. Historically, this has been a triggering point for massive multi-month rallies.

- What’s left now is the reclaim of the “Active Realized Price” level, which sits at around $2,900. Once ETH puts this behind, the return of solid bullish investor confidence is imminent.

ETHUSDT 1 Week Chart, Source: TradingView

A golden cross appeared on the MACD (Moving Average Convergence Divergence) indicator on the weekly ETHUSDT chart. This spells massive upcoming capital allocation in ETH markets.. Golden Crosses have a golden reputation for sparking significant rallies in previous cycles.

Now that’s a “golden” pro-tip for your ETH bags🤓

Alt season is also about to take off. It’s time to get those juicy profits in with every passing price milestone. Hope to see you make the best of this bull ride.

Funds Were Not ‘SAFU’ On This SUI DEX😑

Source: @WhaleInsider

SUI believers had their souls sucked out with the $260 million Cetus Protocol hack.

And why not? Cetus was SUI’s most prominent DEX, not some side-chain or a random dApp.

Until now, DEXes were considered a “safer alternative to CEXes (centralized exchanges). But, looks like this hack has shattered that perspective. And the aftermath?

- CETUS crashed by 40%

- Multiple Sui tokens dropped over 90%

- SUI/USDC pool alone lost $11M

- Trading halted, swaps failed, users couldn’t exit or buy the dip

The attacker used spoof tokens like $BULLA and $MOJO to manipulate liquidity pools, bypassing pricing logic and draining LPs. Stolen funds were bridged to Ethereum, and the attacker is sitting on 9,200 ETH, as of now🫣

SUI validators had to intervene, freezing ~$162 million of the hacker’s funds, in a show of a rare ‘centralized’ move in a decentralized ecosystem.

Even though the move went totally against the “ethos of decentralization,” it was probably the right thing to do at the time.

But the damage has already been done.

- The TVL drop is massive. It has crushed confidence in SUI DeFi for the foreseeable future.

- Trust was the product, and it just got vaporized in one exploit.

- Will the validator freeze move restore confidence in SUI? This remains to be seen.

We’ll keep you posted about how this drama unfolds. Until then, follow safe trading practices. Don’t risk more than you can afford to lose.

It surely has been an eventful week (When is any week or day uneventful in crypto land lol)

We can feel the bullishness in the air, and we are sure you can too. But don’t overdo things. Caution is never a bad idea.. Keep skimming those profits periodically with every local top. Don’t let your gains get lost in the noise and crazy hysteria. Ciao!👋