Welcome back, DDians! The US finally slashed benchmark interest rates this Wednesday after a whole year. Crypto markets look upbeat, and the time is prime for the next leg of the rally to begin. The question is, when will it actually start? Read on to know our take on the cues that could pave the way for the next ultra-bullish storm.

Here’s what we have for you in this issue –

- Rate cuts ready to shake up the market

- Circle 🤝 Hyperliquid

Are the rate cuts enticing enough for the bulls? 🤨

Wednesday saw the US Federal Reserve approve a 25-basis-point rate cut, which lowered benchmark interest rates to sub-4.25% in the 4-4.25% interest rate range.

Rate cuts have always spurred massive rallies in risk-on assets, especially US stocks

In 8 of the last 10 easing cycles, the S&P 500 rose an average of 11% in the following year.

Crypto markets have also always been influenced by rate cuts, with those during COVID and last year paving the way for significant upward movement. But is this latest rate cut enough to pull in a fireworks show?

- As per Simon Dangoor, head of fixed income macro strategies at Goldman Sachs Asset Management, a full-blown rate cut season is upon us. The FOMC (Federal Open Market Committee) is targeting 2 rate cuts this year.

Source: @3orovik

- BMO strategist Brian Belski says cheaper small-cap valuations (forward P/E 15.5 vs. 22.7 for the S&P 500) are well-positioned to benefit from easier credit.

- Long yields have already risen while short yields are falling.

- If the curve steepens on Powell’s comments, risk assets breathe easier.

Source: @StealthQE4

- If it flattens or inverts further, stagflation fears will roar back.

And what’s the risk?

- Federal rate cuts today could look like 2007—too little, too late, fueling stagflation.

- Wholesale prices remain elevated thanks to tariffs, according to Yale Budget Lab.

- According to McDonald’s CEO Chris Kempczinski, affluent households are continuing to spend, but middle/lower-income consumers are pulling back.

- The Fed still has a dual mandate—rate cuts can’t ignore inflation still running above target.

In all of this, the market sentiment remains optimistic, with bulls showing no signs of backing down.

Circle and Hyperliquid Are Now 🫂

Things are getting hyper for Hyperliquid. Institutions are joining forces with the DEX, forging win-win partnerships. Last week, it was BlackRock and Anchorage Digital. This week, it’s none other than Circle. Yes, after its NYSE debut, Circle is pretty much a Wall Street institution now.

Circle is rolling out a native USDC on Hyperliquid’s L1—on top of the existing bridged version that already has nearly $6 billion flowing through it.

Source: @jerallaire

What happened

- Circle launched native USDC on Hyperliquid, alongside a HyperEVM version and cross-chain CCTP v2 support.

- Circle acquired HYPE tokens, making it a direct stakeholder in the ecosystem.

- The issuer already earned $109 million from Hyperliquid activity and holds 8.2% of the total USDC supply on the chain.

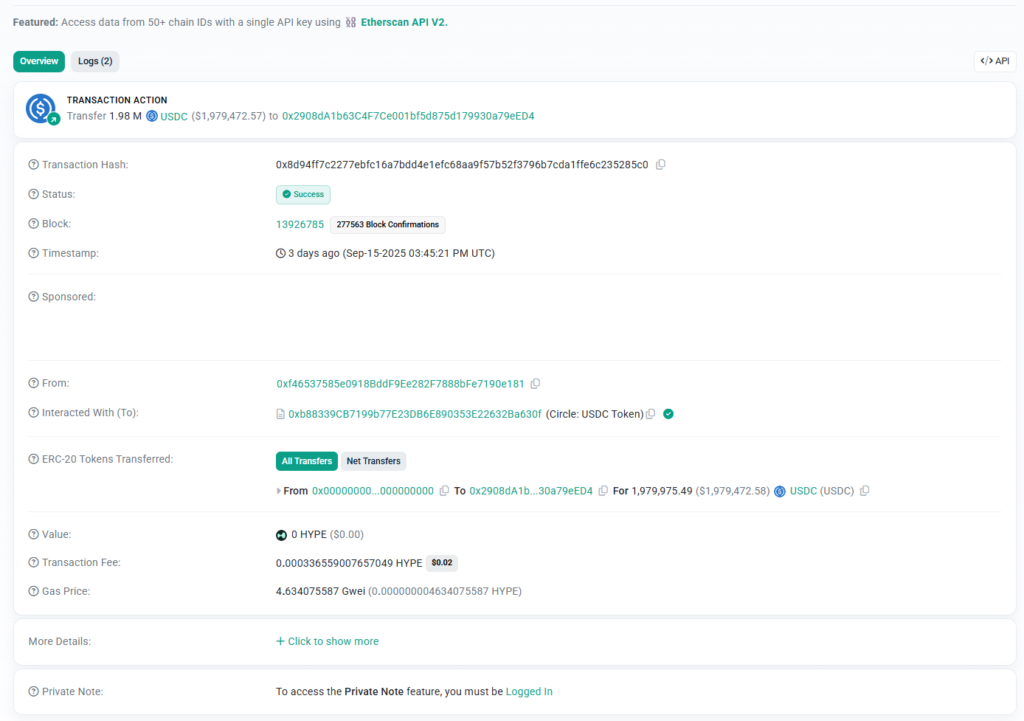

- Hours before the announcement, Circle quietly bridged 2 million USDC from Arbitrum to HyperEVM—a small but symbolic move.

Why is this big?

- Big Fee Stream: Analysts estimate USDC’s dominance on Hyperliquid could generate up to $200 million in fees for Circle.

- Liquidity Proxy: USDC deposits are basically a heartbeat monitor for Hyperliquid activity—from $49 million whale inflows to $400 retail deposits.

- Easier Cross-Chain Liquidity: With CCTP v2, Hyperliquid users can shift funds across ecosystems seamlessly, widening its reach.

Users and the community in general have turned super bullish on Hyperliquid as a platform.

HYPE, the platform’s native token, is trading at $55.9 after posting a new all-time high around $60.

Volatility is high, but sentiment remains bullish in the long term, with forecasts predicting it will surpass $80 by the end of 2025.

And with Circle staking HYPE and holding a revenue share, Hyperliquid just got another layer of credibility.

Markets are primed with bullishness all around. The stage is set. And we are waiting with bated breath and our topped-up bags. We hope you, too, are playing the patience game, as that’s the one thing that will generate the highest profits for you, not just this season but in every season.

Just stay put and wait for the curtain to rise.

That’s all for now from our end. See you at the next one.

Ciao 👋