¡Hola, DDians! We are back with another issue. Cryptocurrency prices have found the bottom through sell-offs and range trading activities. Institutions are buying and building positions, with global macroeconomic factors propelling increased risk behavior among market participants in the near future. In short, there will be ample opportunities for scooping fat crypto profits. The following stories will explain why. Read on!

Here’s what we have for you in this issue:

- Is Bitcoin trailing gold?

- CZ scratched Trump’s back, and Trump’s scratching his now

Bitcoin ready to follow Gold’s recent footsteps 📈

If history is anything to go by, BTC price will explode upwards in a face-melting rally.

What history, you ask?

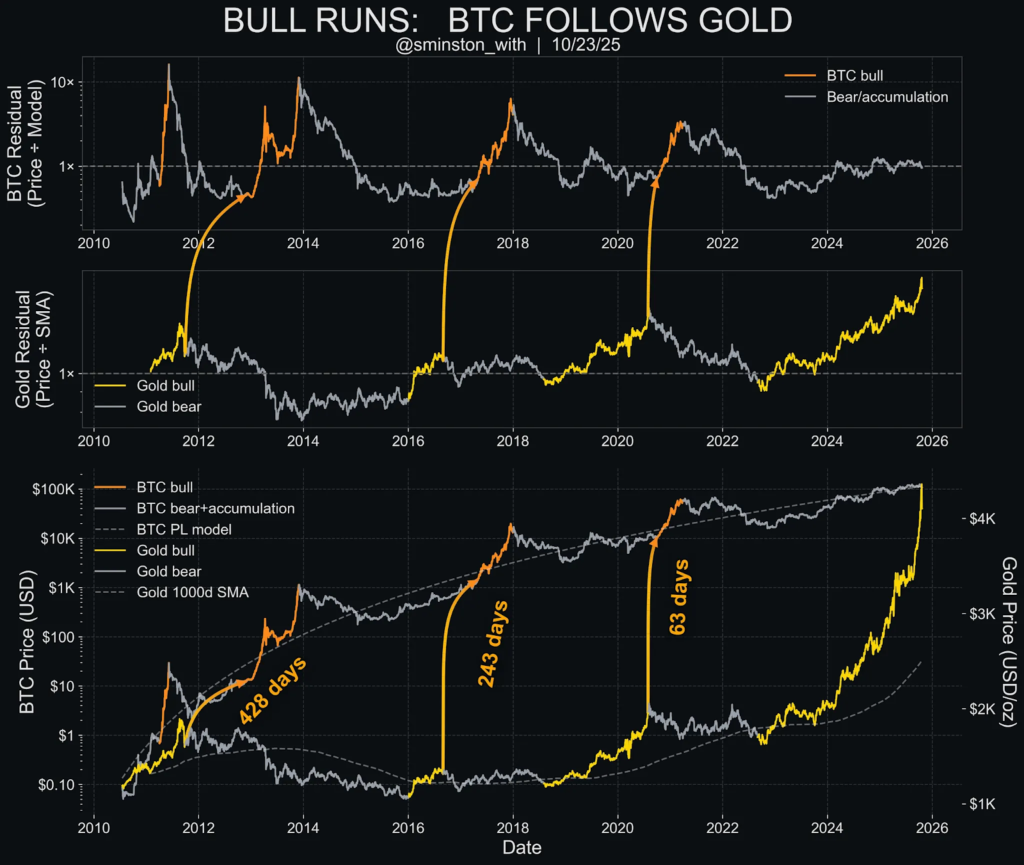

BTC has been following the precious metal’s upward trajectory for the last 14 years.

Every major Bitcoin bull run since 2011 has followed gold’s breakout with a lag of 200–400 days. That pattern has never failed.

And guess what? Gold just went vertical again.

Gold hit $4,370, while Bitcoin is hovering around $110,000.

If you were shocked, confused, and bewildered by the recent crash and all the hullabaloo on crypto Twitter regarding ETF flows and leverage wipes, just keep calm and sit tight.

Because the real signal is hiding in plain sight: gold’s parabolic move.

According to data from @sminston_with, Bitcoin has consistently shadowed gold’s bull runs—with a delayed but amplified effect.

- 2011 gold surge → 2013 Bitcoin mania (lag: 428 days)

- 2016 gold breakout → 2017 BTC rally (lag: 243 days)

- 2020 gold spike → 2021 BTC ATH (lag: 63 days)

Now, in 2025, gold has again broken out of a long accumulation phase—climbing 60% YTD to over $4,350 per ounce, setting a fresh all-time high.

If the correlation holds, Bitcoin is within months of its own parabolic run right now.

And you know what’s even more interesting?

This chart 👇

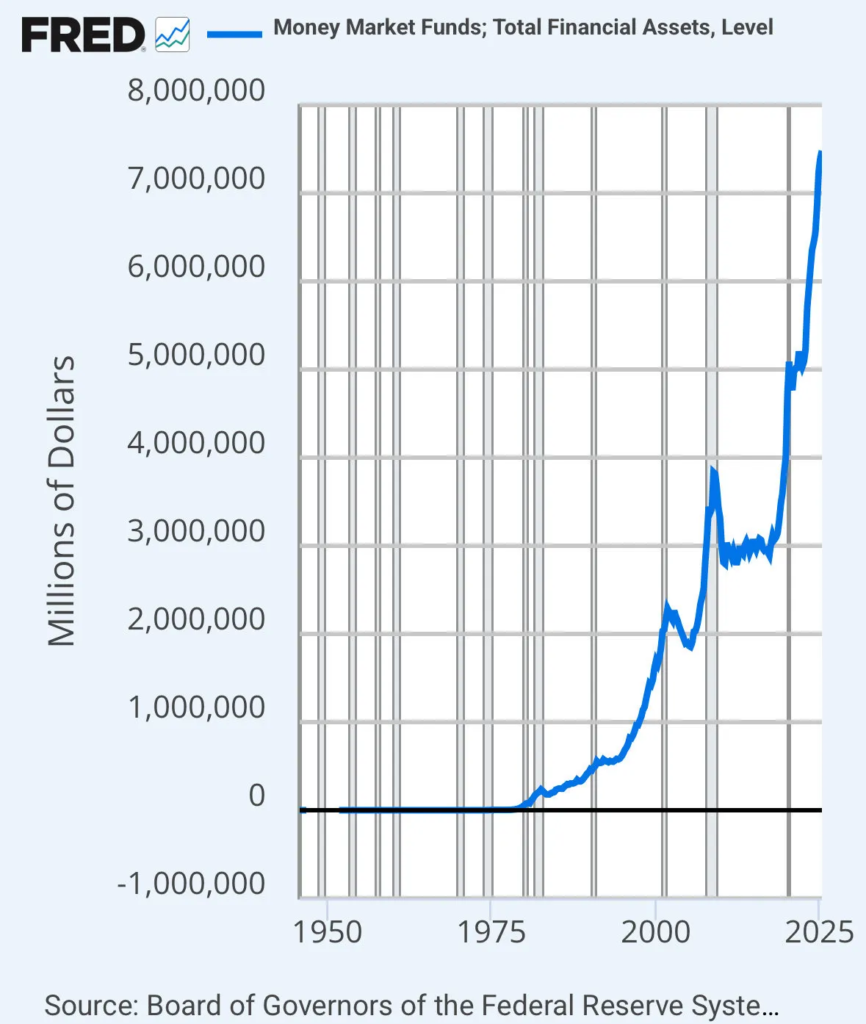

Over $7 trillion is currently sitting in U.S. money market funds—parked, idle, and waiting for the U.S. Federal Reserve’s chair Jerome Powell’s go-ahead on further rate cuts.

Once it happens, that $7 trillion will be put to work.

Gold has already absorbed the first wave.

Next in line? The harder, scarcer, digital version. Bitcoin.

Now you may ask…

Why do we sound so confident?

You see, gold’s rally wasn’t driven by hype—it was driven by central banks buying record amounts after the U.S. seized Russia’s reserves in 2022.

Bitcoin’s parallel story? ETFs and treasuries.

Together, they’ve absorbed over 1.3 million BTC since early 2024—more than quadruple the new supply.

Yet, Bitcoin hasn’t gone parabolic. The keyword here is yet.

Price-sensitive sellers and overleveraged traders have been cashing out.

But when that seller base dries up—just like it did for gold earlier this year—liquidity and scarcity will collide.

And you very well know what happens next 😉.

Gold has already made its move.

Bitcoin’s gearing to do the same.

More upcoming bull run signs—Trump pardons CZ. 🤝

President Donald Trump has officially pardoned Binance founder Changpeng “CZ” Zhao, clearing the path for the world’s largest crypto exchange to return to the U.S. market.

What Happened

Trump signed the pardon on Wednesday, ending CZ’s legal troubles less than a year after his release from prison for violating U.S. anti-money-laundering laws.

The White House statement framed the move as the end of “Biden’s war on crypto,” claiming Trump was restoring fairness and innovation.

Behind the scenes, though, reports say that Binance had spent months lobbying for the decision, hiring top political fixers and quietly supporting Trump’s own crypto project — World Liberty Financial.

Source: @cz_binance

- Binance backed World Liberty’s USD1 stablecoin, which now powers much of the Trump family’s new digital-asset venture.

- The exchange also accepted a $2 billion investment in USD1 earlier this year—a deal that reportedly “catapulted a huge leap” in Trump’s personal wealth.

- Sources say Trump’s allies were in active talks to buy a stake in Binance’s U.S. arm as part of a long-term partnership.

In short, CZ helped Trump’s crypto empire grow, and Trump helped CZ walk free.

No wonder the markets went green…

The news lit up the charts:

- BNB surged over 4.7%, touching $1,149 before cooling.

- World Liberty Financial (WLFI) jumped 15%, trading at $0.14.

- Even CZ-themed meme coins like 4 spiked 30% in a few hours.

Bitcoin and Ethereum followed the wave, recovering from recent macro jitters sparked by the U.S.–China trade tensions.

For CZ, it’s a comeback story. For Trump, it’s a billion-dollar alliance.

For the rest of the industry, it’s a reminder that in 2025, crypto isn’t just about code. It’s about politics and control.

And here’s the thing.

Money is married to control.

Crypto markets were eventually going to become a controlling ground for people with deep pockets and political clout.

This control has moved markets in the past and will continue to do so in the future.

So, there goes your signal.

We hope you are reading between the lines and preparing well to reap the benefits of the above developments.

Just be patient and play your coins right.

That’s all for now. See you in the next one.

Ciao👋