Hola amigos! We are back again amidst an intensely bullish arena with sky-high spirits. Altcoins have started posting double-digit weekly gains, with Bitcoin looking strong to hit another all-time high. Oh yes, it is that time of the year. It is that time of this bullish season. The stories below will explain why. Happy reading!

Here’s what we have for you in this issue:

- Solana’s 👑 mode is so on

- SharpLink’s new ETH strategy 💪

- Hyperliquid is leveling up

Solana Printing Billions in Profits 🤑

Solana is establishing itself as an insanely profitable layer-1 blockchain.

When compared with Ethereum, the top smart contract chain, Solana reported a revenue of $1.25 billion, while the latter generated less than half of that—$523 million.

Source: @0xMert_

This phenomenon isn’t just a flippening in fees. It’s a fundamental shift in where the crypto economy is generating value.

The numbers:

Source: @solana

- Solana revenue YTD: $1.25 billion

- Ethereum revenue YTD: $523.28 million

- Other notable players:

- Hyperliquid: $501.7 million

- TRON: $450.5 million

- Binance Chain: $148.9 million

- Bitcoin: $134.9 million

- Base: $54 million (top L2)

This dominance started in late 2024, when Solana pulled in more revenue than every other L1 and L2 combined in Q1 2025. That streak isn’t over. Yet.

But here’s something interesting.

Most of Solana’s revenue isn’t going to the chain itself. It’s going to dApps.

Top earners in the last 30 days:

- Pump.fun: $52.8 million

- Axiom Pro: $50.7 million

- Jupiter DEX, Meteora, and Phantom Wallet are also in the top ten.

- Solana itself? Just $4.56 million in chain fees.

That’s the difference: Ethereum captures fees at the protocol level. With Solana, the story is different. dApps are the ones printing cash.

Why should you care?

Solana’s got everything going for it—something that layer-1 blockchains only dream of.

- App-first economy: Solana dApps are hitting milestones faster than you can blink and making crypto history.

- Axiom Pro hit $200M in revenue in just 202 days (faster than Pump.fun did).

- Institutional validation is incoming: Forward Industries plans to deploy $1.65B directly into SOL for a new treasury.

- Market momentum: SOL just hit $216, up 19% in the last 30 days, and briefly touched a $100B market cap milestone in record time.

This combo—dApps generating cash, institutions stockpiling SOL, and market cap parity with big tech milestones—is why Solana’s story isn’t just about TPS anymore. It’s about dollars.

Which makes us say. The next ATH for SOL isn’t just a question of speculation—it’s a matter of math.

Are you strapped in for the ride?

An ETH-Powered $1.5B Share Buyback 😮

SharpLink is doubling down on its own stock.

The company is using its Ethereum staking revenue and a debt-free balance sheet to pull it off.

What’s the intended message?

That their own stock is undervalued compared to their $3.6 billion ETH stash.

Why the move?

- SBET trades at a $3.14 billion market cap, while their ETH stash alone is worth $3.6 billion.

- ETH is up 2.2% in the last month, while SBET stock is down 31%.

- Co-CEO Joseph Chalom says it’s “accretive” to repurchase stock instead of issuing new equity at a discount to NAV.

When your stock trades below the value of your treasury, you either wait for Wall Street to catch up… or make the move yourself. SharpLink chose option two.

The entire play might project an impression of desperation. But buybacks are a vote of confidence.

SharpLink is telling investors that its ETH-heavy balance sheet is stronger than the market thinks.

Hyperliquid Is Moving Up In The World 😎

How life started for Hyperliquid: as a scrappy DeFi exchange.

How’s it going for Hyperliquid now? It’s about to launch its own platform-native stablecoin. That’s a long way to have come.

If approved, Hyperliquid’s go-to stablecoin could be indirectly backed by the world’s largest asset manager—BlackRock. Yes, the BlackRock.

The DEX’s native token, HYPE, is already “high on the news.”

Source: @raintures

What happened?

- Hyperliquid currently runs on Circle’s USDC and Tether’s USDT, but the community is looking for a “Hyperliquid-aligned” stablecoin.

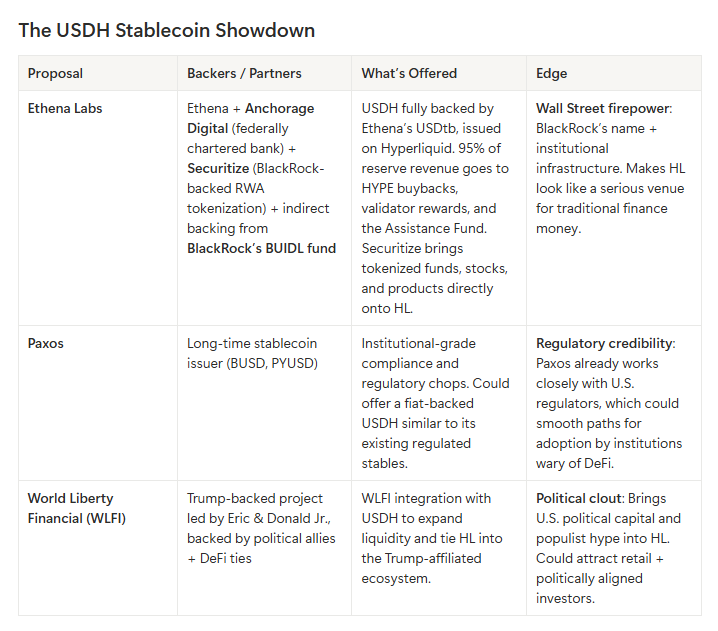

- Proposals so far: Paxos, World Liberty Financial (Trump-backed), and now Ethena Labs.

- Ethena pitched USDH backed by USDtb, its synthetic dollar issued via Anchorage and collateralized by BlackRock’s $BUIDL fund.

- At least 95% of revenue from reserves would flow back into Hyperliquid’s Assistance Fund, validator rewards, and HYPE buybacks.

- Robert Mitchnick, BlackRock’s Head of Digital Assets, literally put his name on the proposal.

Why does it matter?

This isn’t just another DeFi experiment. It’s the convergence of Wall Street firepower and heavy-duty DeFi infrastructure.

- BlackRock’s indirect involvement gives USDH credibility and could unlock deeper institutional liquidity.

- Anchorage and Securitize bring bank-level custody and tokenized RWA rails.

- Hyperliquid, with $5.7B in stables already on-chain, suddenly looks like a serious alternative venue for capital-heavy players.

If USDH takes off, Hyperliquid won’t just be “another DEX.” It becomes the first DeFi chain with a native stablecoin backed by BlackRock.

Why It Matters

- Ethena = Wall Street stamp of approval. BlackRock’s indirect involvement is a legitimacy bomb.

- Paxos = Compliance angle. Safe, boring, but could help with regulators.

- WLFI = Political theater. If Trump wins more power, this link could supercharge adoption.

The Bigger Picture

- Hyperliquid’s HYPE token ripped 20% on the news, trading at $54.

- Institutional DeFi is heating up: Paxos, Trump-linked WLFI, and now Ethena are all vying for the same slot.

- The winner of USDH could end up shaping how capital flows through Hyperliquid’s $5 billion+ ecosystem.

And, you could turn a fortune on your altcoin bags, given all the exciting stuff that’s happening in the crypto market right now. We know we definitely will. The time is finally here. All you need is the right amount of patience and greed to exit at the right time.

Volatility will be sky-high, so we suggest practicing caution and control.

That’s all for now. See you at the next one.

Ciao👋