GM DDians! Bitcoin is getting bigger and bolder. Nothing seems to slow down its bullish momentum. We hope it stays this way for a long, long time in the future. Fingers crossed🤞

While the Orange Coin does its thing, we bring to you the factors and events powering its rise and other exciting, carefully curated crypto market insights, so that you can make your best hay, while the crypto sun shines bright!🌞

Here’s a glimpse of what we have for you in today’s issue:

- Bitcoin’s Booming Baby!🤑

- Ripple: Stirring Up Dubai Real Estate🔥

- What’s Up With TRON’s TVL?🤨

No Stops For The “Bitcoin To the Moon Train”🚀

Bitcoin is amping up its “bullishness quotient” unapologetically.

Last week wasn’t just about BTC hitting a new all-time high of $111,888. Some other pivotal events also took place:

- Michael Saylor-led Strategy added more BTC to its ever-growing “Bitcoin coffer.” According to Saylor’s recent post, the company purchased 4,020 Bitcoins worth $427 million at approximately $106,237 per coin. Strategy now holds over 580K BTC at an average price of ~$69,979.

Source: @saylor

What’s interesting about this purchase is that it didn’t happen with debt or any sort of leverage. Strategy raised funds for their latest BTC shopping milestone through a $2.1 billion $STRF “At-The-Market (ATM)” Program. This is a fancy but convenient way of raising capital leveraged by publicly traded companies, through stock sales directly in the open market. The sale of shares happens at the prevailing spot rates or ask prices.

Source: @saylor

- JP Morgan CEO Jamie Dimon made it official for the bank’s clients to buy Bitcoin, with the only reservation of not providing custody services for their BTC holdings. Well, this is not the best case scenario, but it is exciting nevertheless. We are happy as long as institutional interest and the value of our BTC bags keep rising 😉

- The US Senate advanced the GENIUS stablecoin regulation bill. With a $230 billion (and growing) market cap, stablecoins have become the lifeblood of crypto markets while facilitating efficient cross-border payments and capital holding alternatives. This bill will set the groundwork for reserves, audits, disclosures, and law enforcement compliance.

Source: @wwe

- A “Texas Bitcoin Reserve” moved closer to reality. Termed “Senate Bill 121”, it was passed in a 101-42 vote by the state’s House of Representatives. With the Governor hopefully signing it off, another US state (After Arizona and New Hampshire) jumping on the Bitcoin-led crypto bandwagon will finally become a reality.

Can’t get any more bullish than this, right? Hold on! There’s more. This week:

- The Bitcoin Conference is on in Las Vegas.

- The Federal Open Market Committee (FOMC) will convene to discuss the next steps in proceeding with the monetary policy. It’s time they acknowledged the elephant in the room!

- US GDP data comes out on Thursday.

- $9.64 billion worth of BTC options expire on Friday, and the Bitcoin mining difficulty reaches a new all-time high of 125 TH on Saturday.

BTC is growing bolder and better on the back of:

- Institutional buying

Source: @glassnode

- Regulatory momentum

Source: @SecScottBessent

There is no stopping the “Bitcoin To The Moon Train”😍

Ripple’s Big “Habibi Come To Dubai” Moment🤝

If you are an XRP holder, then this piece of news will at least take you to cloud 9 if not Dubai (for now).

Dubai’s real estate is going gung-ho on blockchain, and Ripple’s XRP ledger is making big moves in the space..

Yep. You read that right.

XRPL is now officially bringing Dubai real estate on-chain.

Source: @RippleXDev

Here are the details:

- Property deeds will be tokenized on Ripple’s XRP Ledger (XRPL).

- Tokenization infrastructure platform, Ctrl Alt is the tokenization partner for Dubai Land Department’s (DLD) Real Estate Tokenization Project.

- Real estate ownership can now be fractionalized.

- Multiple co-owners will now be able to share ownership of a single property with a minimum investment of AED 2,000.

- The project is expected to spur the growth of an AED 60 billion ($16 billion) tokenized real estate market by 2033, which is equivalent to almost 7% of Dubai’s total transactions.

Source: @reece_merrick

While Ethereum and Solana compete for dominance in the smart contract development pie, XRPL just went ahead and cracked the deal for the multi-trillion-dollar real estate pie. That’s an exciting new use case for blockchain and crypto, after cross-border payments.

Dubai is quietly becoming the RWA capital of the world, with Ripple (and XRPL) as its “RWA Right Hand”. And if you think this is Ripple’s only RWA win in the UAE, think again:

Ripple has already:

- Invested $5M in a money market fund on XRPL (via Abrdn).

- Invested $10M in tokenized US treasuries (via OpenEden).

- Secured a payment license from the DFSA to serve institutions in the UAE.

With real estate added to the mix now, Ripple’s expansion to RWAs is starting to look a lot more serious.

The company has had its share of tumultuous roller coaster rides in the US, its homeland. Multiple SEC lawsuits had stifled Ripple’s growth prospects. As a result, XRP (XRPL’s native token) prices tanked.

With Ripple winning against the SEC, XRP recording new all-time highs, and XRP ETFs on the way, Ripple is quietly laying the foundations of its empire in the Middle East.

And not with big talk and hype, but with regulated infrastructure.

Is TRON’s TVL a Ticking Time Bomb?🤔

Two “TRONs” have been trending this year. Once is the upcoming Hollywood film, TRON: Ares (a standalone sequel to TRON: Legacy, which was a chef’s kiss of a film).

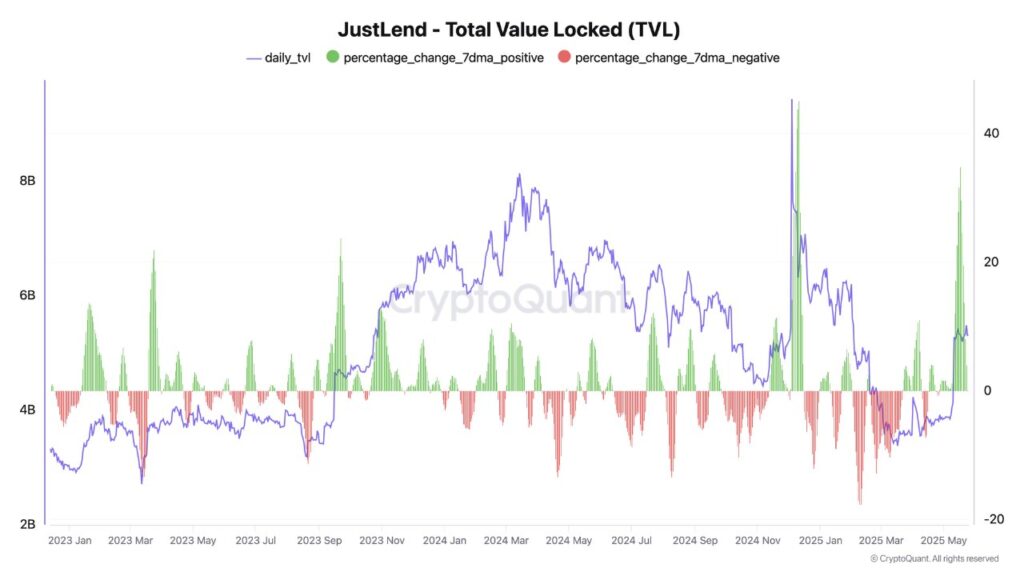

And a blockchain we’re all familiar with – TRON. Why? TVL (Total Value Locked) on the Justin Sun-founded chain surged by over $2 billion in 2 weeks. That’s one of the biggest single-year spikes.

Data from the above chart shows an upward-moving, 14-day TVL delta.

At the center of this TVL spike is JUST DAO, a prominent DeFi lending dApp on TRON, accounting for over $1.5 billion in TVL.

And that’s not all. USDT issuance on TRON, too, has spiked sharply since January this year.

Source: @joao_wedson

TRX prices have also remained strong for the same timeline, indicating that TRON’s network activity is booming.

With the “DeFi on TRON” narrative receiving a considerable boost, a price rally could follow (rising stablecoin issuances also support the same). Historical data also supports what we predicted.

But, swelling TVL numbers are also “bogs in disguise”, and it’s best to be careful and watch out for signs. Here’s why:

- Greed boosts yields

- Yields attract capital

- TVL surges

- Then comes the fall

When yield-hungry users chase erratic, ludicrous APRs (Annual Percentage Rates) on-chain, it creates an unsustainable vortex that sucks everything within itself, eventually leading to disaster.

Think of it like musical chairs — everyone’s dancing until liquidity thins out.

And right now? TRON is dancing hard.

If you are a DeFi yield farmer on TRON, this is a time to harvest carefully, not ape blindly.

Although you can take a shot at playing with TRX prices, especially as the market looks ripe to welcome another alt season. Liquidity doesn’t lie.

Hype makes and breaks things in the crypto market. If you know how to play the hype well, you will be rewarded richly. All you have to do is stay focused and not get lost in the noise.

Capiche? Ciao! See you in the next one👋