Yo DDians! How have you all been? The market’s been going through a downer lately, that’s for sure. Except for a few privacy tokens, every coin has registered double-digit losses from recent local highs. But let’s not despair. Overleveraged positions were wiped out, creating strong support for future rallies.

How do we say that with confidence?

Because the institutions are involved, and they’re deeply invested for the long haul. So, take this correction with a pinch of salt and read on to stay updated on the latest happenings in crypto land 😉.

Here’s what we have for you in this issue:

- The retreat of BTC whales

- Bittersweet SOL symphony

Bitcoin Whales Throwing In The Towel? 😨

While we continue to remain hopeful of more upside volatility in the near future, it seems long-term Bitcoin holders are jumping ship.

On-chain data and technical indicators suggest that long-term holders—often seen as the market’s strongest hands—have begun offloading coins, signaling possible turbulence ahead.

Over the past 30 days, roughly 400,000 BTC have been sold by wallets typically associated with long-term investors. This marks one of the sharpest distribution phases since midyear and suggests that these investors are either taking profit or positioning for a potential correction.

And that’s okay.

It could be interpreted as a bearish sign. That’s one way of looking at it.

However, it may also indicate a transition phase—with whales redistributing coins to new entrants ahead of the next accumulation cycle. And that’s what Burak Kesmeci, an on-chain researcher, has also opined.

“If long-term holders stop selling, that could mark a local bottom,” Kesmeci noted, implying that capitulation among seasoned holders often precedes recovery.

Source: @burak_kesmeci

The weekly Bitcoin chart also signals a local bottom.

But technical indicators say otherwise

Longer-term indicators have flipped to “Sell.”

InvestTech’s algorithmic model has downgraded Bitcoin to a “weak negative” signal for the next one to six weeks.

However, despite the negative sentiment associated with Bitcoin’s current market scenario, what is immediately visible is the BTC/USD pair’s consolidation within a horizontal channel between $100,000 (support) and $125,000 (resistance).

A breakout above or below these levels could determine BTC’s next move.

Volume trends also indicate underlying weakness: Bitcoin has seen higher trading activity during price declines and lower volume during recoveries—a pattern consistent with distribution.

Overall, Bitcoin’s technical setup remains mildly negative.

For long-term investors, the current wave of whale selling could either mark the early stages of a reset or the quiet groundwork for the next accumulation phase.

Either way, the signal is clear: Bitcoin’s strongest holders are moving, and the market is watching closely.

SOL’s Rally Lost Soul Despite ETF Launch 📉

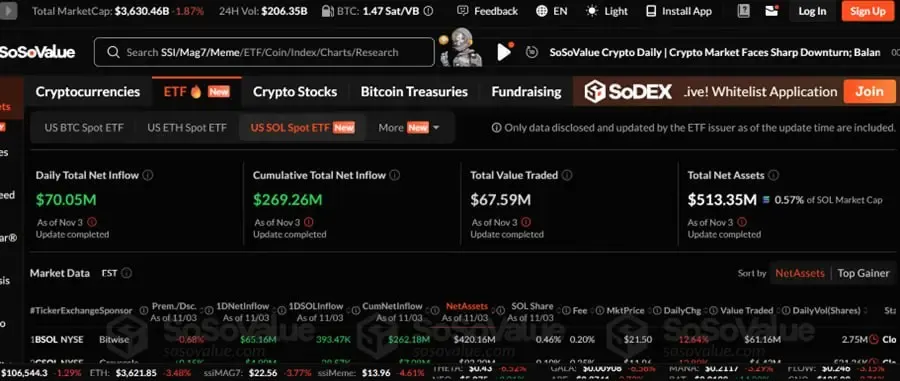

SOL ETF launches were a hit, but the market had other plans.

Despite Solana’s long-awaited ETF debut pulling in monster inflows, the blockchain’s native token plunged almost 20%, underperforming both Bitcoin and Ethereum.

SOL ETF launches were a hit

Bitwise’s Solana ETF (BSOL) made a blockbuster start, attracting $417–$421 million in its first week—enough to place it among the top 20 ETFs across all asset classes by net inflows.

Bitwise launched BSOL with $223 million in seed capital, far ahead of Grayscale’s modest $2.2 million start. The fund is also leading altcoin ETFs in ongoing demand, pulling in $65 million in fresh inflows this week alone.

But sentiment is weak, despite strong fundamentals

Solana still hosts over $40 billion in user assets and remains one of the most active blockchains by transaction volume. But the market hasn’t been particularly rewarding for those fundamentals lately.

SOL is trading near $162 and is down 30% over the past month. By comparison, Bitcoin and Ethereum are down 15% and 22%, respectively, over the same period.

Despite the downturn, all is not doom and gloom.

Matt Hougan, CIO at Bitwise, remains unfazed:

“Investing in Solana is a bet on the network’s role in powering stablecoin transfers and tokenized assets,” he said. “If we’re right, both the market and Solana’s share of it will keep growing.”

Solana’s ETF debut proved that institutional demand is real, but market sentiment still calls the shots.

Record inflows didn’t stop the bleeding—and for now, traders seem to be selling the news faster than Wall Street can buy it.

True, there’s fear on the streets, but it is in this fear that conviction is built and patience is rewarded. With the US Federal Reserve kickstarting QE (quantitative easing) from December 1, risk-on sentiment is sure to return, and with it will return explosive positive volatility.

So, this is just the calm before the storm. For when the storm comes, rallies will leave eyes watered.

This is our conviction and belief.

That’s all for now. See you at the next one.

Ciao 👋