Hola DD amigos! We are back with another edition of hot, juicy crypto market updates for you to help you make the best of the ongoing crypto summer. Ether’s all-time high paved the way for the rest of the altcoins to carry the momentum forward. And while Bitcoin’s taking a breather, the market in general has presented numerous opportunities to book interim profits for bagholders like us and yourselves.

But that’s just the beginning of the good stuff—the upcoming few months hold the keys to exponential wealth creation. How? Read on to know more! 😉

Here’s what we have for you in this issue:

- ETH: the best is yet to come

- SOL’s the new sweetheart of institutions

- Could Bitcoin correct to $100K?

ETH Isn’t Done Rallying Feel Analysts 🚀

The native Ethereum crypto token may have stalled its rally for the time being. But a bigger move will soon follow.

No, don’t heed us. The claim’s been made by ace market pundit and CIO of Fundstrat Capital, Thomas Lee.

Source: @fundstrat

While the majority of the trading and analyst community called for significant drawdowns owing to “overbought conditions,” Lee nonchalantly downplayed the drama. He expects ETH to log gains beyond $5,000 to as high as $5,450.

A quick look at the ETH/USD weekly chart solidifies Lee’s claims. Ether’s weekly momentum has shown no signs of slowing down. Although there are indications of a bearish takeover, that doesn’t spell doom for ETH’s overall bullish narrative.

And with ETH’s bullish narrative, we mean:

- ETH will hold $4,000 as the floor, according to Fundstrat’s Lee and Mark Newton.

- They expect a rally to $5,450, with a “near-term” rebound in motion.

- Myriad prediction markets indicate an 80% chance of ETH hitting $5,000 this year.

- Tailwinds: ETF inflows, regulatory clarity, stablecoin and RWA adoption, and institutions steadily adding ETH to treasuries.

But then why do the bears sound skeptical?

- As per analysts David Morrison and Simon Peters, the ETH/USD pair looks technically overbought, with MACD flashing exhaustion. MACD is an abbreviation for Moving Average Convergence Divergence, a market indicator in technical analysis parlance that provides insights into the strength, direction, and momentum of a market trend.

- September is historically one of crypto’s worst months (BTC and ETH both tend to dip).

- Potential Fed surprises could trigger another risk-off move.

- Some argue that while Bitcoin looks cleaner technically, ETH may need a sideways chop to cool off.

What’s the big picture?

- If bulls are to be believed, ETH will dart beyond $5,000 and maybe even $6,000.

- The worst bearish case would push Ether towards $4,000, and frankly, that’s okay.

- But BTC has to maintain its strength nonetheless, preferably $100,000; otherwise, all will be doomed.

Realistically speaking, Ether has had its share of a massive 250% rally since April 2025, so a brief pullback seems healthy. It’s better to stay plugged in for the long-term game. IYKYK 😎

Solana: Institutional Bet, Play, Love (upcoming, we mean…) 😍

The institutions did it with Bitcoin. Now they’re doing the same with Ethereum. And Solana’s next in line.

If you still don’t get the context, nearly $3 billion worth of new Solana-focused Digital Asset Treasuries (DATs) have been announced. The conversion of public companies into Solana Treasury Vehicles has officially begun.

And the playbook? Lock supply, raise equity, and load up on SOL.

A quick look at SOL’s rising weekly momentum will confirm the building institutional trend. And don’t mistake it for retail hype because it’s not.

Here’s What Happened

- Sharps Technology: Raised $400 million to launch a Solana treasury, backed by ParaFi, Pantera, FalconX, CoinFund, Arrington, plus $50M from the Solana Foundation.

- Galaxy Digital, Multicoin, and Jump Crypto are teaming up to raise $1 billion, with Cantor Fitzgerald advising, to build a Solana treasury via public company acquisition.

- Pantera Capital: Planning a $1.25 billion raise to turn a public company into a Solana-focused investment vehicle.

- DFDV: Closing a $125 million equity raise this week to expand Solana holdings.

That’s ~$2.75 billion in new treasury demand announced within a single news cycle.

And what is it leading to?

- This is the first wave of corporate treasuries in Solana’s ecosystem. BTC has MicroStrategy, and ETH has BitMine. Now it’s SOL’s turn to shine as a treasury asset.

- Market cap-adjusted, $3 billion in Solana treasury demand equals roughly $17 billion in Ethereum treasury demand. That’s the equivalent of the top 15 ETH DATs combined.

- These moves could accelerate the shift in Solana from being a retail player to becoming an institutional favourite at scale.

Source: @Arthur_0x

What’s the big picture?

Bitcoin paved the way. Ethereum followed. Now Solana is gearing up for its own corporate treasury moment.

If these treasuries close, we’re looking at billions in fresh demand landing in weeks. Add that to Solana’s already surging DeFi, NFT, and developer activity, and you’ve got the makings of an all-time high situation in 2025.

Buckle up, because the Solana DAT race just started, and it could turn into the defining trade of next year.

Is Bitcoin Price Going To Drop To $100K? 😱

BTC dipped below $108K, but is a pullback to $100K incoming?

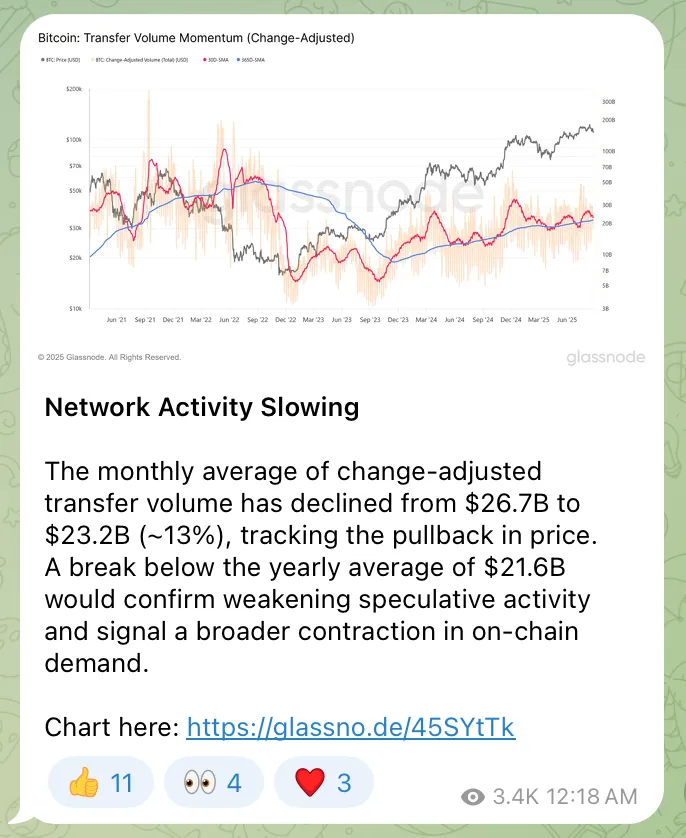

- On-Chain Red Flags: Adjusted transfer volume is down 13%, slipping toward yearly lows. Glassnode warns that if it breaks $21.6 billion, it signals a broader demand contraction.

- ETF Outflows: Bitcoin ETFs continue to bleed capital, with flow-to-price models pointing to $107K and warning of a potential drop below $100K.

- Long-Term Holders Selling: Profit-taking by old hands is now the second largest on record compared to prior cycles, historically marking late-stage phases.

Source: @glassnode

September is coming

- With average returns around 3.77%, September hasn’t been a happy month for Bitcoin traders for the last 12 years.

- Traders are wary, with many advising against new long positions unless BTC reclaims $118K convincingly.

What’s the big picture?

- Let’s look at it from the point of view of a cool-off phase.

- Bitcoin’s macro tailwinds (Fed cuts, ETF infrastructure, institutional allocation) are still intact.

Overall, it is quite evident that the market is taking a breather, which is natural at this point, as momentum is expected to strengthen in the days ahead. Altcoin markets have much to gain. Similarly, BTC benefits from its developing macro fundamentals. Our advice is always simple: look at all rallies as profit-skimming opportunities, as it is tricky to time the market top. A bird in hand is worth two in the bush. 😊

And with that, we would like to take our leave. See you at the next one.

Ciao👋